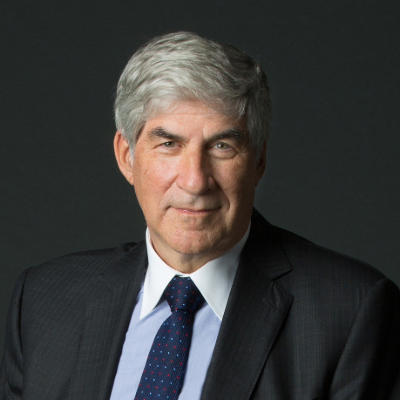

The story of Bruce Kovner, who went from driving taxis to becoming one of the most successful people working on Wall Street.

Page Contents

It’s fascinating and motivating to overview his life path from a small merchant to one of the largest hedge fund managers in the USA and the proof of the successful application of the main principles of the strategy and risk management rules. Here Bruce Kovner’s biography, and the amount of money he possesses now, as well as the main success factors are described.

Where was Bruce Kovner born? Early Life

Bruce Stanley Kovner was born on February 27, 1945, in The Bronx, New York Though he was young his talents could not be ignored. He was also a good basketball player and played piano well, apart from being a good student.

Kovner initially tried to do a Ph.D. in economics at Harvard University but he failed and stopped writing due to the worst, writer’s block. This moment brought him to New York City where he worked as a cab driver and as a student of the harpsichord at Juilliard.

Kovner started his financial voyage in 1977 with $3000 for which he invested cash and borrowed it from a credit card. This initial capital was in soybean futures contracts, which, through his sharp traders’ skills, he was able to take to $45,000 before making a bad trade which reduced his profits by half.

This was something that seasoned him in risk management, something that would work for him in the future when trading.

Bruce Kovner Career Highlights: Rise to Prominence

The hedge fund Caxton Associates was started in 1983 by Kovner which specialized in macroeconomic strategies at the global level. Within those years Caxton rose to the top of the financial business mainly due to Tavistock’s leadership.

Before the crisis it controlled more than 14 billion dollars in assets and the average was 14% per year. Kovner’s approach to trading was characterized not only by detailed calculation of probabilities but also by covering psychological characteristics of a particular market.

Kovner had been the CEO of Caxton for almost three decades before he stepped down in 2011. Caxton had constant performance and enhanced hedge fund management performance, which are some of the achievements he brought to the company. Currently, the firm still functions under new leadership, but it does so on a basis established by Kovner.

Bruce Kovner Net Worth: Earnings

While one of the best Bruce Kovner quotes is ‘The key to business is people’, he has been enjoying the fruits of his labor and as per the records and estimation in April 2024, he is worth about $ 7.7 billion.

This figure puts him in the ranks of billionaires in America and has acquired his wealth from managing hedge funds and as an investor. Most of his wealth he earned from working at Caxton Associates and later invested through CAM Capital, the company which he set up in 2012 to oversee his investment.

Kovner is more than just a hedge fund manager, he’s been heavily involved in various industries, such as the pharmaceuticals and real estate businesses. More significantly, he has been a member of some boards of organizations and established himself as a philanthropist.

Overview of Philanthropy and Personal Life

Other than his impressive financial success, Bruce Kovner is also remembered for his giving hands. He was also a chairman of Juilliard School; he has more involvement in the business of Lincoln Center for the Performing Arts and Metropolitan Opera. His passion for finance is education and the arts, as evidenced by his belief in contributing to society.

Kovner has been married twice and the mother of three children from both marriages. He is currently living with his wife, Suzie Fairchild in several houses in New York, Florida as well as California.

Conclusion

Bruce Kovner went from being a New York taxi-cab driver endeavoring to strike it rich to being a billionaire hedge fund tycoon who has changed the face of finance. It is pivotal to note that his experience reflects probably the most basic qualitative values including; perseverance, planning, and learning that the prospective investor can practice and apply.

In thinking about Kovner’s accomplishments and donations between the financial organization and philanthropy, success is the amassment of wealth and giving back to society.

Also Read, Aeko Catori Brown, Jordana Lajoie, and Cogeian Sky Embry.