The troubled corporate empire of Indian multibillionaire Gautam Adani has received an investment of $1.87 billion (£1.6 billion) from a U.S. asset management firm.

Adani informed investors that Florida-based GQG Partners has acquired shares in four of the group’s entities.

That is the first substantial investment disclosed by the company since short-seller Hindenburg Research accused it of stock market manipulation and financial wrongdoing.

Adani Group has refuted the claims

Since the publication of Hindenburg Research’s research on January 24, Adani Group’s seven publicly traded firms have lost an estimated $135 billion in value.

The GQG investment will be divided among four Adani firms, including Adani Enterprises, the parent company.

“This transaction demonstrates the sustained faith of global investors in the governance, management practices, and growth of the Adani portfolio of companies,” said Jugeshinder Singh, the chief financial officer of the Adani Group.

Mr. Singh continued,

“We appreciate GQG’s position as a strategic investor in our infrastructure and utilities portfolio of renewable energy, logistics, and energy transition.”

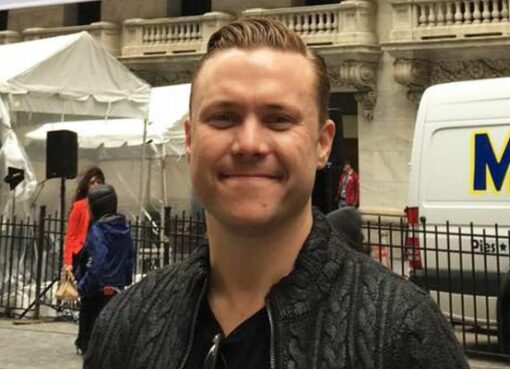

Rajiv Jain, chairman and chief investment officer at GQG, opined that “these companies have considerable long-term growth prospects.”

Mr. Adani is largely considered one of the most successful businessmen of his generation, he noted.

In a separate regulatory filing, Adani Enterprises refuted media allegations that it had acquired $3 billion in financing from a sovereign wealth fund.

“We would want to explain that the aforementioned news item looks to be a market rumor, so it would be improper for us to comment,” the company added.

Earlier on Thursday, India’s Supreme Court announced that it has created an impartial panel to investigate the charges made against Adani Group entities by US short-seller Hindenburg Research.

The company stated that Adani firms participated in “brazen” stock manipulation and accounting fraud for decades.

In addition, it asserted that the companies’ “considerable debt” placed the entire group on “precarious financial footing.”

A short sale is a wager that the value of an asset will decline.

Adani Group has disputed the claims and referred to them as an “attack on India.” It had previously stated, without evidence, that the Hindenburg report was meant to help the US-based short seller to realize profits.

Mr. Adani’s company consists of seven publicly traded companies that engage in a variety of industries, including commodity trading, airports, utilities, ports, and renewable energy.

Also Read: Jonathan Groff, Who Is Out Gay, Discusses A Relationship Gone Wrong